An Audio Universe of

Discovery

&

Connection

The power of Audacy

- #1 Creator of original, premium Audio content

- 200 Million monthly listeners

- 2 Billion annual podcast downloads

- 60 Million monthly digital Audio listeners

News & perspectives

Press Releases

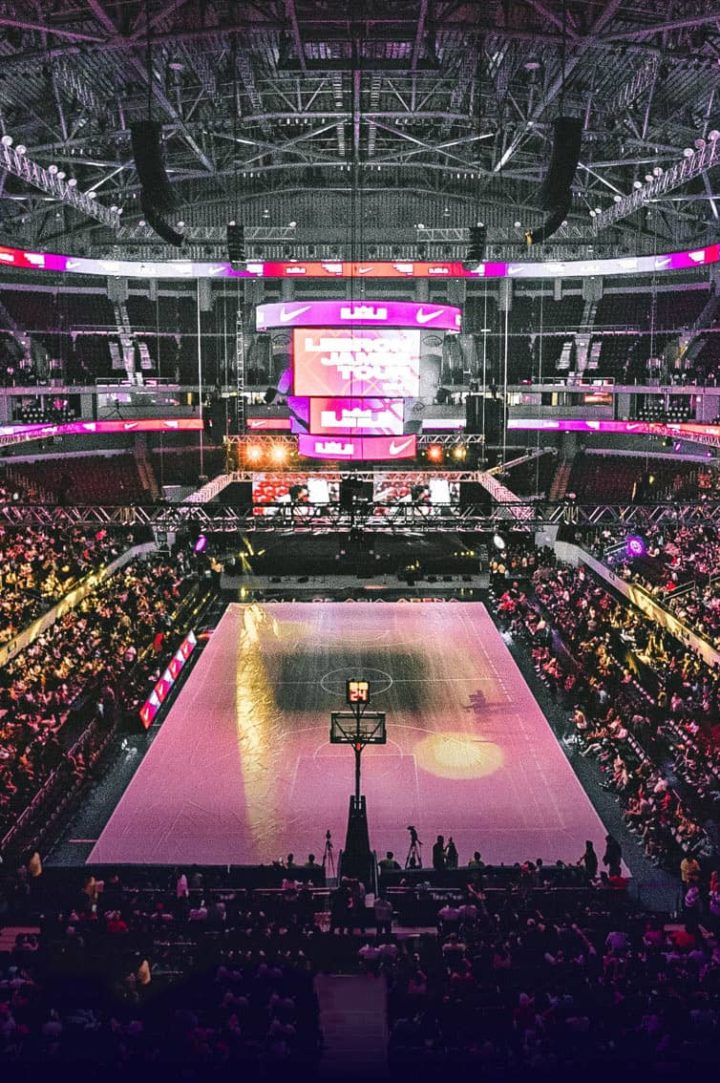

Audacy, the Unrivaled Leader in Sports Audio Content and Entertainment, Launches Audacy Sports

April 23, 2024

Press Releases

Audacy Plans 45 Volunteer Events Nationwide to Celebrate Earth Day as Part of Companywide 1Day1Thing Sustainability Initiative

April 17, 2024

Press Releases

Audacy and ElevenLabs Strike Partnership

April 12, 2024

Webinars & Videos

Podcast Playbook: How to Run a Successful Podcast Campaign

Webinars & Videos

The Infinite Dial 2024: Key Trends & Takeaways with Edison Research

News

How Cross-Platform Audio Delivers for Advertisers

March 28, 2024

Press Releases

Audacy Celebrates Women at 4th Annual Leading Ladies

March 21, 2024

Investor Relations Releases

Audacy Provides Strong Performance Update Following Restructuring Plan Approval

March 12, 2024

Research

Exclusive Insights: Unveiling the Power of Audio in the Connected Car

Advertising Tips

True Crime Insider: Tenderfoot TV’s Donald Albright on the Secret Sauce to Podcasting’s Top Genre

Investor Relations Releases

Audacy Receives Court Approval of Reorganization Plan

February 20, 2024

Press Releases

Audacy’s 4th Annual Leading Ladies, Presented by Olay Body, Returns to New York on March 20

February 16, 2024

Press Releases

Audacy Named #1 Sports Podcast Network by Triton

February 12, 2024

Our communities

Reach and connect with your target audience

Our advertising solutions help brands engage with deeply immersed audiences – wherever they are, and however they’re listening. It’s the ROI you want for your marketing investment.